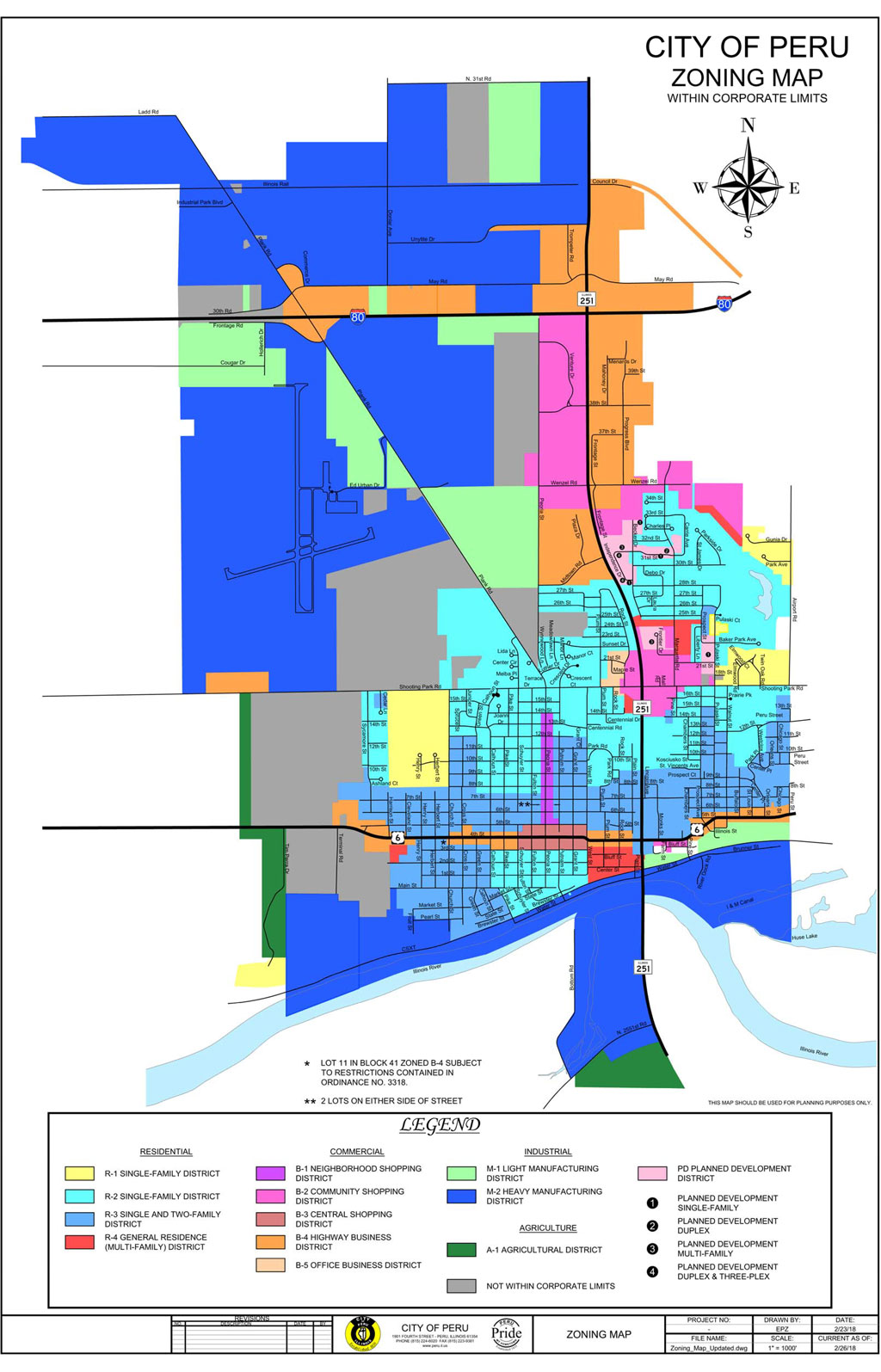

Zoning

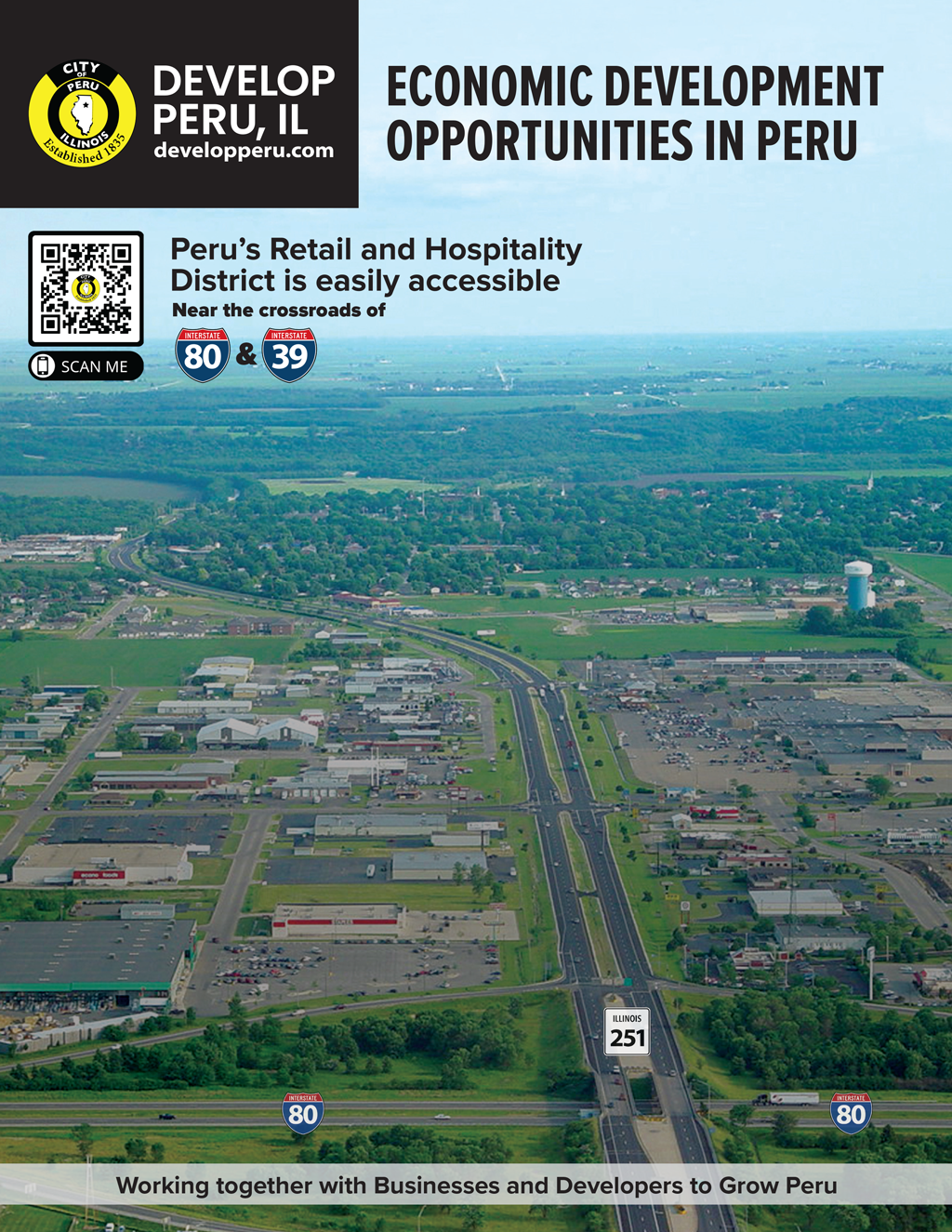

Peru has a long history of working cooperatively with the business to ensure the needs of the project are met. Peru’s goal is to retain and create quality full-time permanent jobs and to encourage private investment. The combination of incentives, locations, transportation, and infrastructure, makes Peru the ideal location to build or expand your office, industrial, warehouse, distribution, retail, and related businesses. Peru has created economic incentive programs, as a means to stimulate business growth and job creation right now. Let us help you bring your business to Peru.

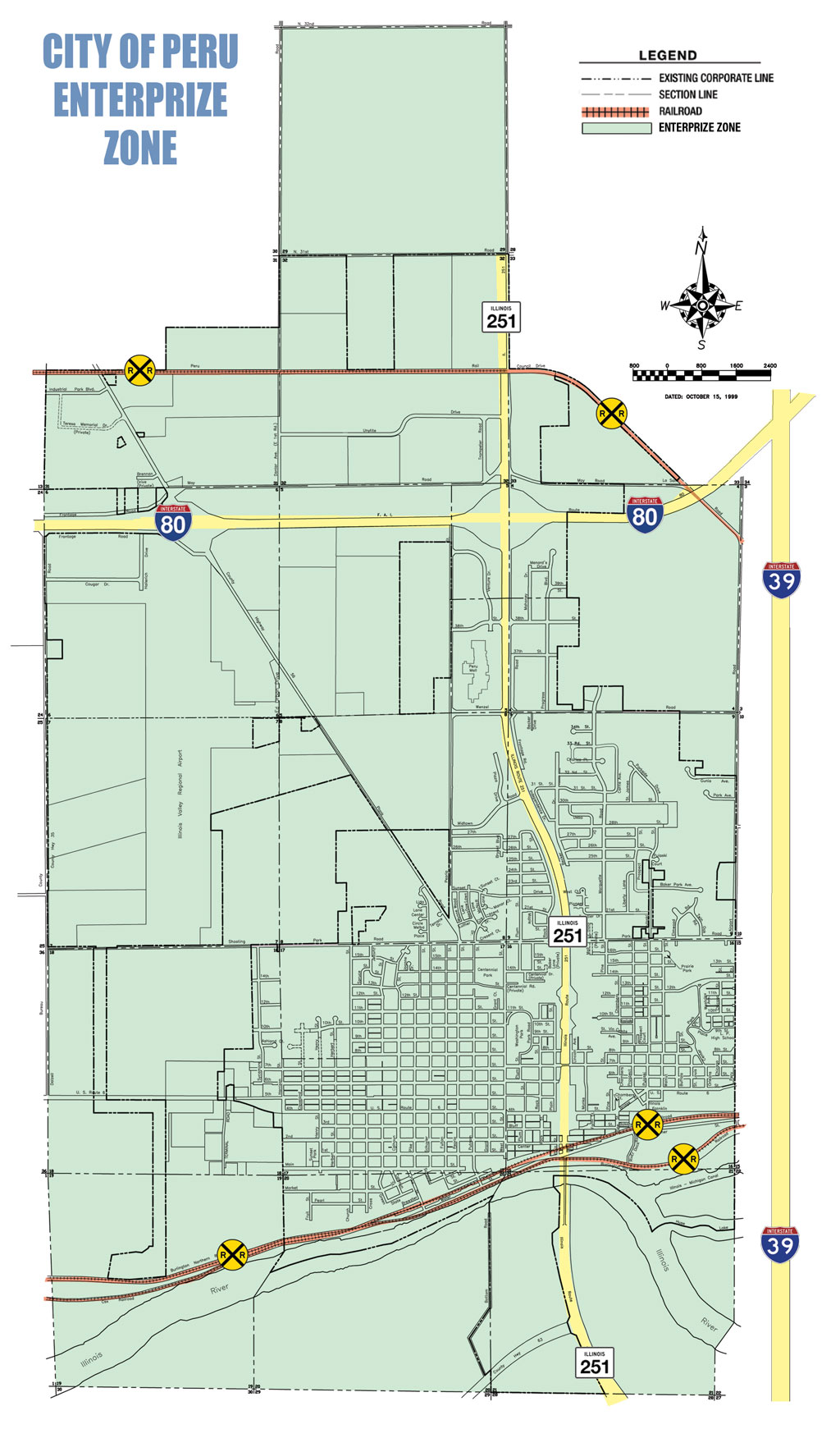

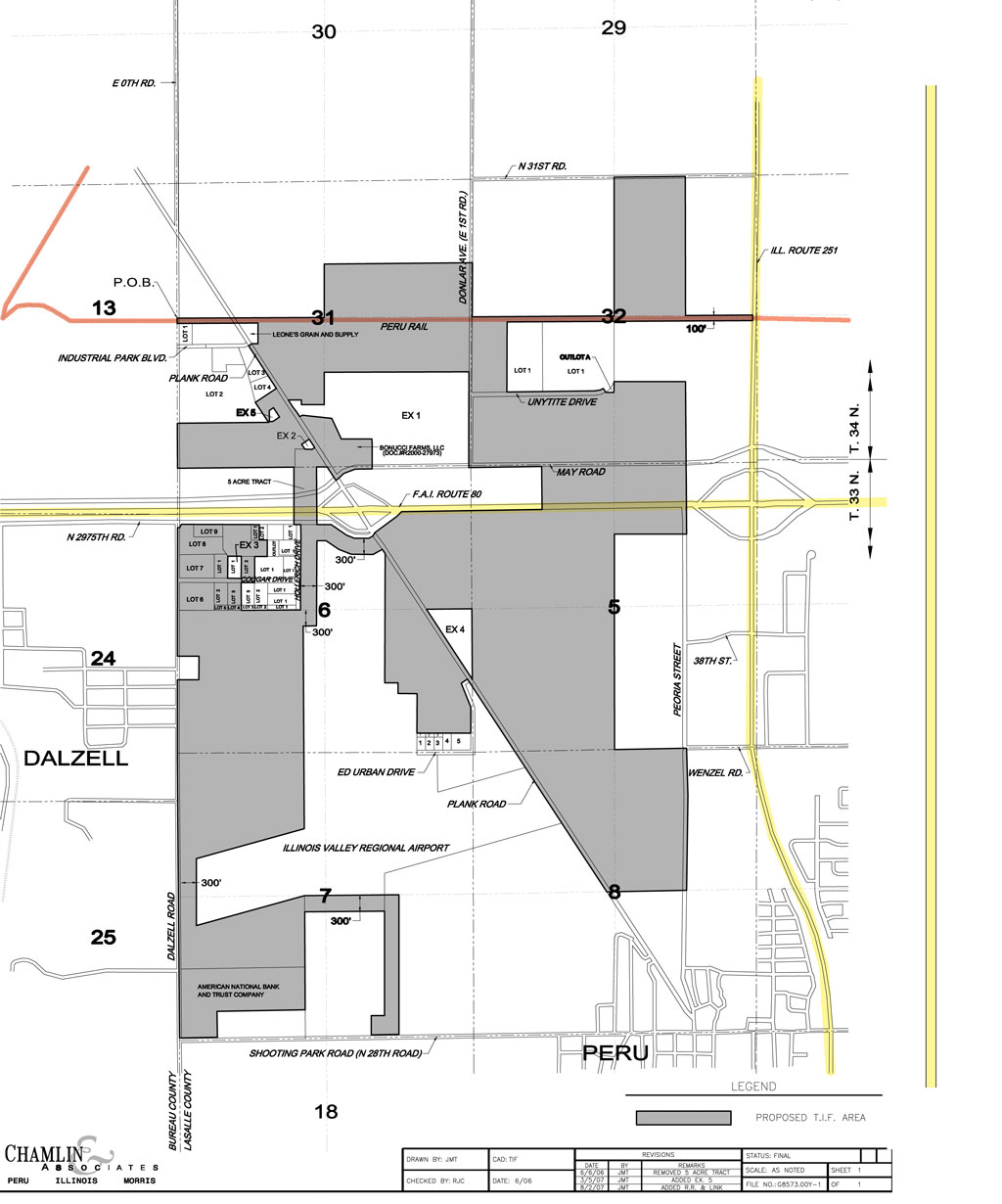

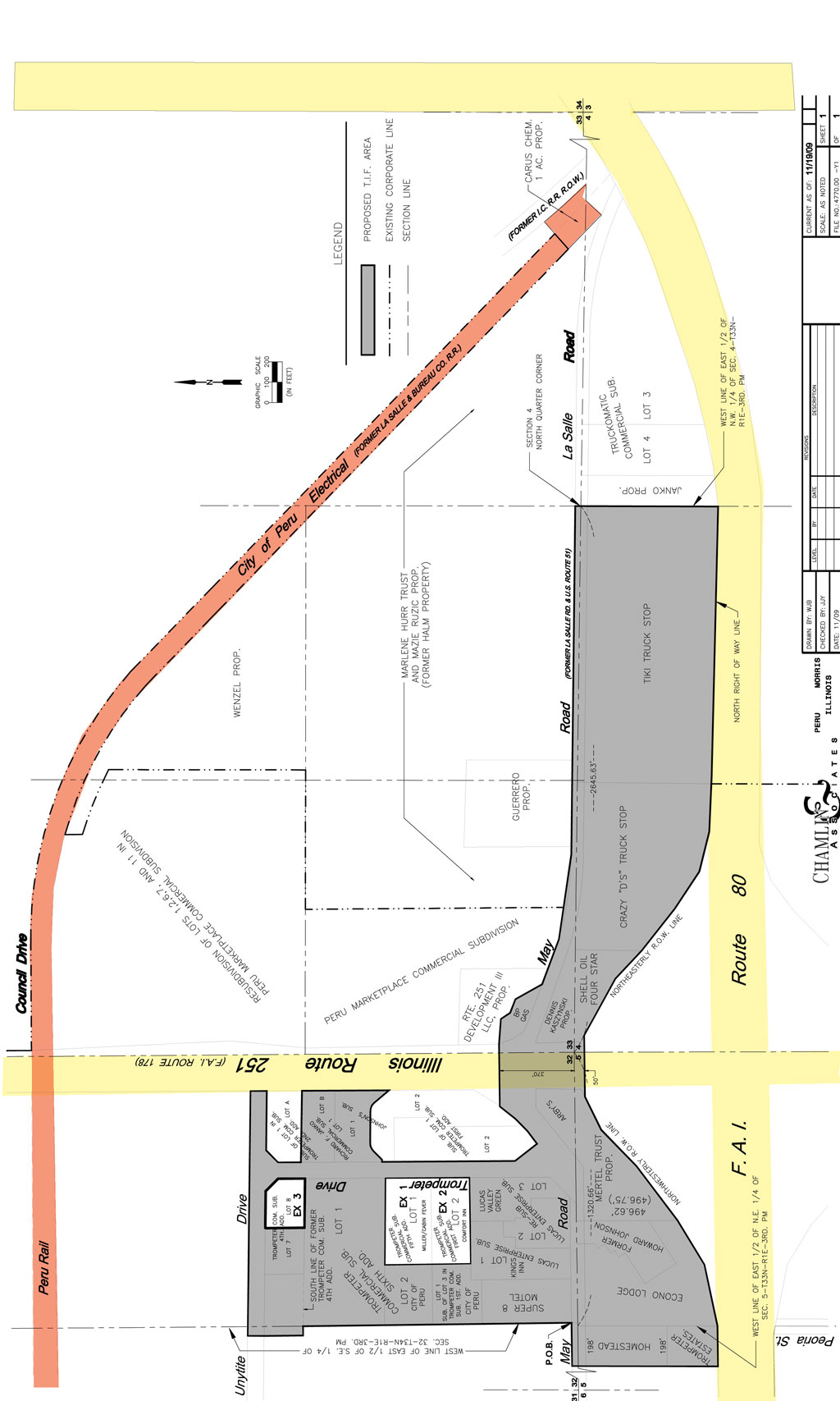

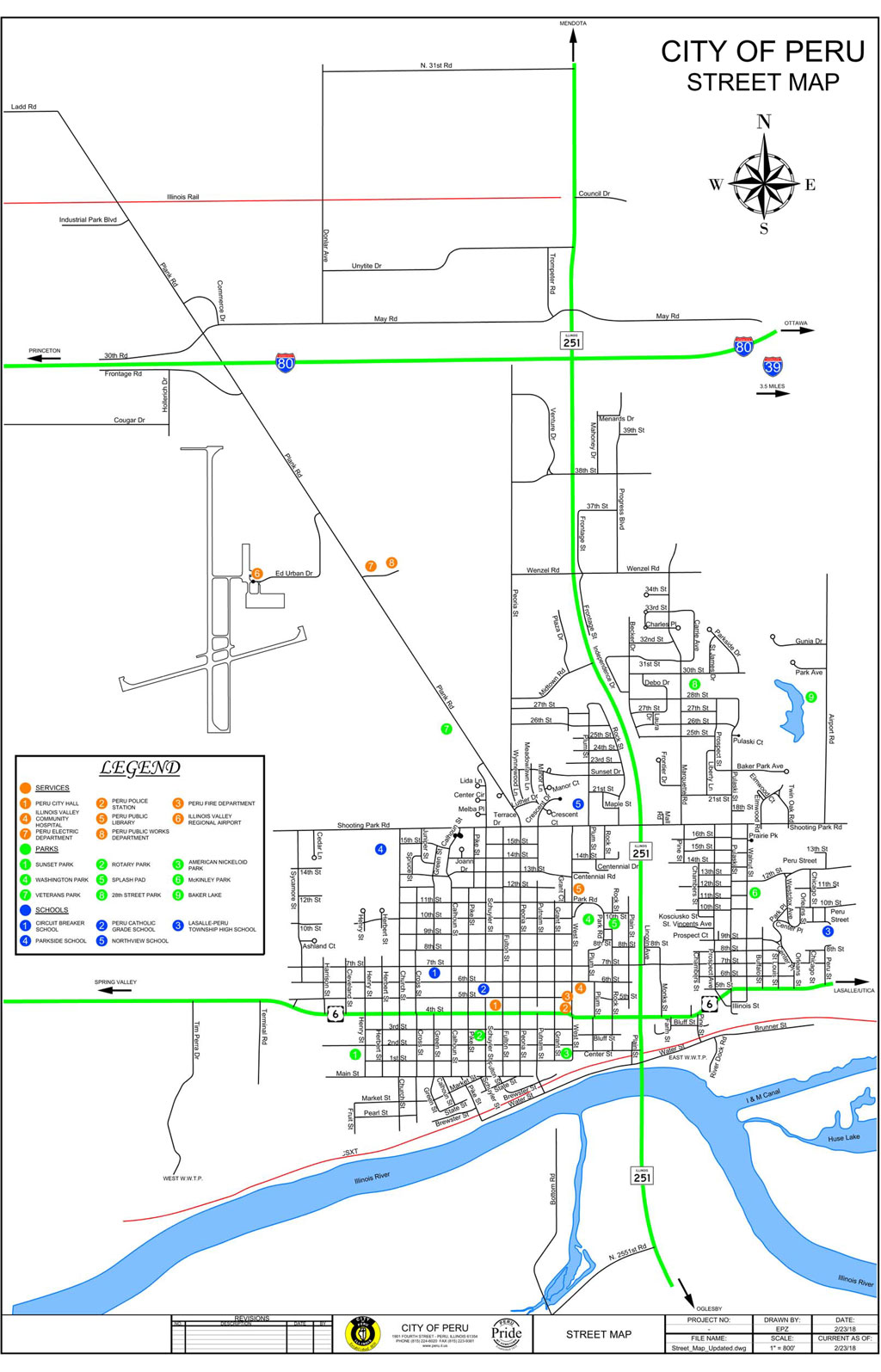

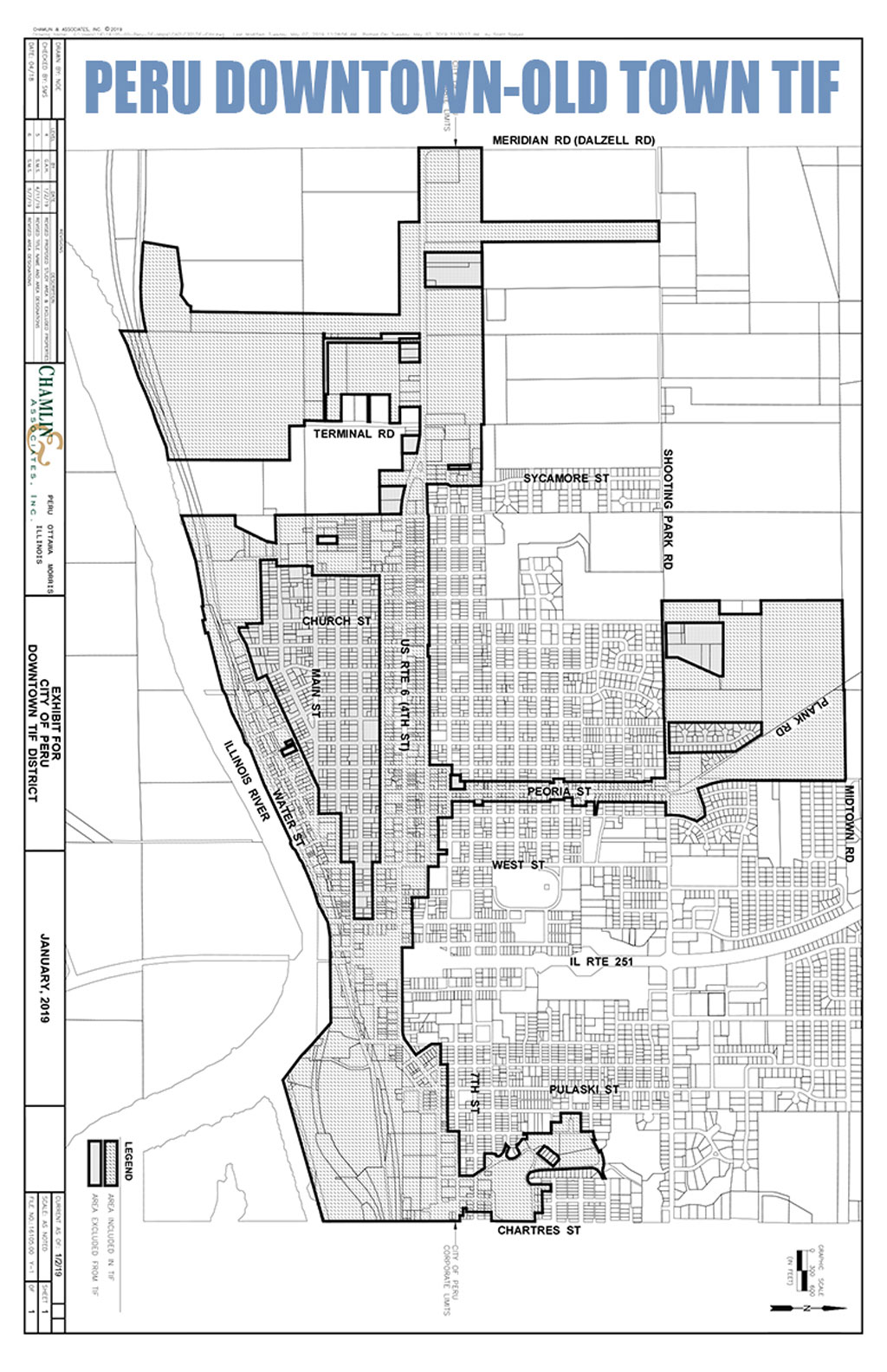

Maps

Peru's Development Incentives

New Enterprise Zone

Peru is now part of the all new enterprise zone encompassing nine counties. The Upper Illinois River Valley Development Authority (UIRVDA) Enterprise Zone Program is designed to provide state tax credits and exemptions as incentives to encourage businesses to make a new investment on property within the Zone. This stimulates business activity and creates new employment opportunities.

The Upper Illinois River Valley Development Authority (UIRVDA) administers the UIRVDA Enterprise Zone (UVEZ). The Enterprise Zone Program is designed to provide state tax credits and exemptions as incentives to encourage businesses to make a new investment on property within the Zone. These benefits can be applied to eligible commercial properties building materials, utilities, consumables, and more.

For more information, contact Bob Vickrey.

- 1901 4th Street Peru, IL 61354

- 815-228-5151

- 815-223-9381

TIF Districts

Description of Eligible Project Costs for a Tax Increment Financing District in Illinois

Categories of permissible redevelopment costs included in the Illinois TIF Act:

- Costs of studies, surveys, development of plans and specifications, implementation and administration of the redevelopment plan. For example, professional service costs: architectural, engineering, legal, financial, planning; and administrative costs related to implementation of the redevelopment plan. (Private & Public)

- Cost of marketing sites. (Private & Public)

- Property assembly costs. For example, acquisition of land and other property, real or personal, or rights or interests therein; demolition of buildings; and site preparation. (Private & Public)

- Costs of rehabilitation, reconstruction or repair or remodeling of existing public or private buildings. (Private & Public)

- Costs of construction of public works or improvements. For example, streets, sidewalks, water, sanitary and storm sewer, etc.; and new public buildings (with some limitations). (Private & Public)

- Costs of eliminating or removing contaminants and other impediments such as site improvements that serve as an engineered barrier addressing ground level or below ground environmental contamination, including parking lots and other concrete or asphalt barriers; and the clearing/grading of land. (Private & Public)

- Costs of job training and retraining projects. (Private & Public)

- Financing costs – up to 30% of interest expense. (Private & Public)

- Obligations secured by the special tax allocation fund… may be issued to provide for redevelopment costs. (Public)

- Approved Capital Costs of taxing districts. For example, all or a portion of a taxing district’s capital costs resulting from the redevelopment project necessarily incurred or to be incurred within a taxing district (including the municipality) in furtherance of the objectives of the redevelopment plan and project when approved by the municipality. (Public)

- Relocation costs. (Private & Public)

- Payment in lieu of taxes. (Public)

- Up to 50% of cost of construction of low income and very low income new housing, owner occupied or rental. (Private)